New Delhi [India], September 12 (ANI): The major rationalisation of GST rates for the road transport and automobile sector provides tax relief for two-wheelers, cars, tractors, buses, commercial vehicles, besides auto components.

This reform is poised to make vehicles more affordable, enhance logistics efficiency, and stimulate demand in both urban and rural markets, according to the Ministry of Road Transport and Highways.

“It will also strengthen MSMEs in the auto-component supply chain, create employment, and promote cleaner, more efficient mobility. By simplifying and stabilising the tax framework, the move boosts manufacturing competitiveness, supports farmers and transport operators, and reinforces national initiatives such as Make in India and PM Gati Shakti,” the statement from the ministry said.

The recent reduction in GST rates across categories of vehicles and auto components is a transformative step that will benefit manufacturers, ancillary industries, MSMEs, farmers, transport operators, and millions of workers in both the formal and informal sectors, the Ministry added.

Among key impacts of the GST rate reduction is lowering prices for two-wheelers, small cars, tractors, buses, and trucks.

It will also lead to higher demand, leading to job creation in manufacturing, sales, logistics, and services; besides expansion of credit-driven vehicle purchases through NBFCs, banks, and fintechs; and stronger Make in India push, improved competitiveness, and cleaner mobility.

“These reforms mark a transformative step–bringing relief to farmers, MSMEs, small traders, women, youth, and the middle class, while ensuring ease of doing business across India. This is more than just a policy change; it’s a step towards empowering citizens and strengthening our economy,” Minister Nitin Gadkari said in a post on X.

The recent GST reforms will bring in benefits across the ecosystem.

Over 3.5 crore jobs in auto and allied sectors are expected to be supported across MSMEs, having multiplier effect on small businesses in tyres, batteries, glass, steel, plastics, and electronics.

Additionally, it will bring in more opportunities for drivers, mechanics, gig workers, and service

The GST rate reduction also incentivises replacement of old, polluting vehicles with fuel-efficient models; besides promoting adoption of buses and public transport, reducing congestion and emissions.

“The GST rationalisation represents a key milestone in India’s drive toward affordable, efficient, and sustainable mobility. By lowering the tax burden on vehicles and auto components, the reform benefits consumers, strengthens the auto ecosystem, supports MSMEs, and boosts employment across both urban and rural India,” the ministry said.

On September 22, the first day of Navratri, all changes in GST rates will come into effect.

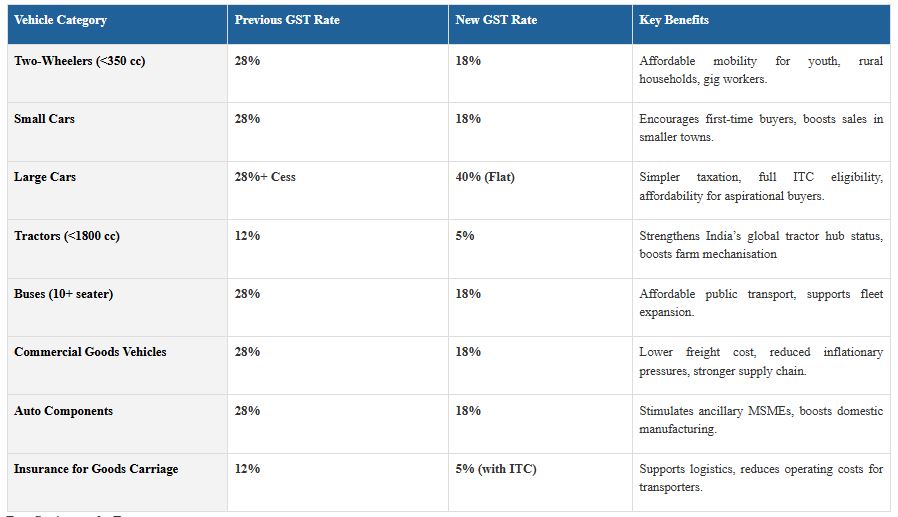

For instance, the rate cuts for the automobile sector are across different categories. It includes bikes (up to 350cc, which also accommodates bikes of 350cc), Buses, Small cars, Medium and luxury cars, Tractors (<1800cc), among others.

The GST rates are also being reduced on auto parts.

For two-wheelers, including bikes up to 350cc, the GST rate has been reduced from 28% to 18%.

For small cars, the GST rate has been reduced to 18% from 28%.

The small car encompasses petrol engine cars of <1200 cc and not exceeding 4 metres in length, and diesel cars of <1500 cc and not exceeding 4 metres in length.

For large cars, however, GST is tagged at a flat 40% with no cess.

For the agricultural sector, tractors, which were previously taxed at 12 per cent GST, will now be taxed at 5 per cent. Tractor tyres and parts, which were in the 18 per cent slab, have also been brought down to 5 per cent.

For buses with a seating capacity of 10+ persons, GST has been reduced from 28% to 18%.

The majority of the components used for the manufacture of motorcars and motorbikes have also been reduced by 18%.

In a historic move to simplify the Goods and Services Tax(GST), GST Council in its 56th meeting has reduced the GST structure from four slabs (5%, 12%, 18%, 28%) to two main rates–5% (merit rate) and 18% (standard rate) along with a 40% special rate for sin/luxury goods. These changes come into effect from September 22, 2025.

Sweeping changes have been made to what the government termed the next-generation GST (Goods and Services Tax) rationalisation.

It came on September 3, just days after Prime Minister Narendra Modi announced it from the ramparts of the Red Fort on Independence Day. This is aimed at reducing the tax burden on citizens while stimulating economic growth. (ANI)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages